How to turn your savings into reliable monthly income

How to Create Income in Retirement

(Without Running Out of Money)

A Step-by-Step Course to Replace Your Paycheck in Retirement

No guessing. No jargon. Just results. You’ll learn:

With Patrick McNalley

Author. Radio Host. Fiduciary Advisor. 25 Years Helping Retirees Get It Right.

Wondering How to Make Your Money Last? You’re Not Alone.

You’ve done the hard work of saving. Now you’re staring at a pile of retirement accounts and asking, “How do I turn this into a paycheck?” That question haunts almost every retiree—and the old rules just don’t work anymore.

You might be feeling:

Creating Income in Retirement: A Crash Course

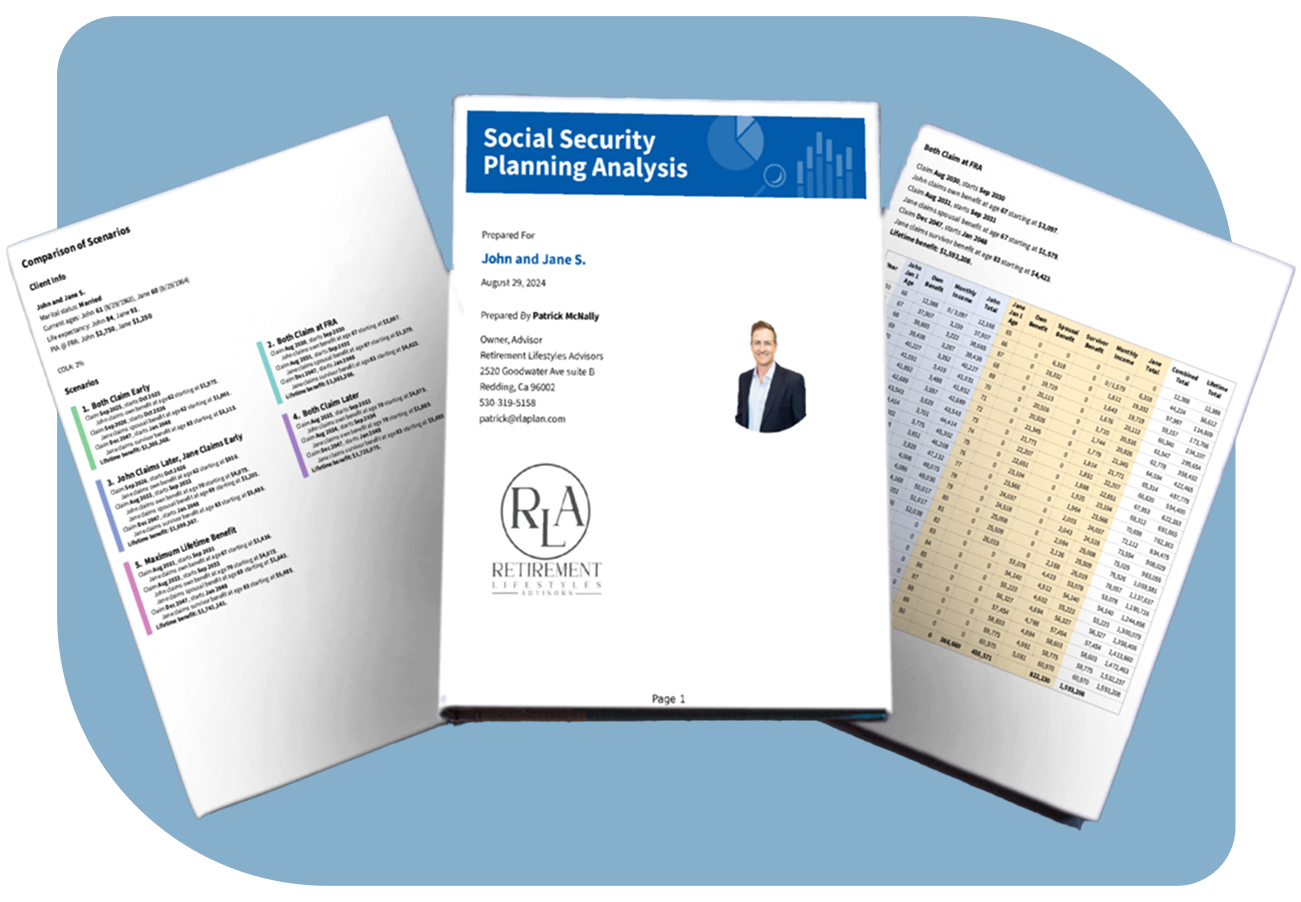

DIY Your Retirement Income Plan —With Expert Help

This 3-part course walks you through the same process I use in my office every day. Whether you’re a DIY-er or just not ready to hire a full-time advisor, this course gives you the clarity you need to build reliable income—without gambling on outdated advice.

What You’ll Walk Away With:

What’s In the Course?

Meet Patrick McNally, The Guy Who Makes This Stuff Make Sense

Patrick started in his dad’s insurance agency over two decades ago, helping retirees with Medicare and life insurance. He quickly realized most retirees had the same fear: “What if I run out of money?” That question launched a career in retirement income planning and eventually led him to become a fiduciary advisor, radio host, and author—committed to helping real people retire with clarity and confidence.

The Smartest $49 You'll Ever Spend

$297 Value. $49 Today

Everything You Need to Build a Reliable Income Plan—In One Easy-to-Follow Course. No fluff, no overwhelm—just practical tools, proven strategies, and the clarity you’ve been looking for.

You’ll Get:

Frequently Asked Question

Is this course just a sales pitch for your services?

Nope. This is a DIY course packed with the same strategy we teach in client meetings—just in a simple, self-paced format.

What if I don’t know anything about investing?

Perfect. This course is made for regular people, not financial pros. No jargon, no spreadsheets, just real-life explanations.

Is this course for me if I’m already retired?

Absolutely. If you’re drawing income—or planning to soon—this will help you maximize what you have and spend with confidence.

What if I want more help later?

We offer done-with-you and done-for-you options if you want deeper support. But this course stands on its own.

How long is the course?

Three short modules (around 20–25 min each). Watch them all in an afternoon or take your time. Lifetime access included.